If you plant trees during the next few years, will they be a profitable investment?

Hamish Levack, New Zealand Tree Grower February 2018.

It is impossible to be sure, but many indications point to continued investment in forestry being well worthwhile. The first question to answer is − Will the profitability be affected by the current national forest plantation age class distribution?

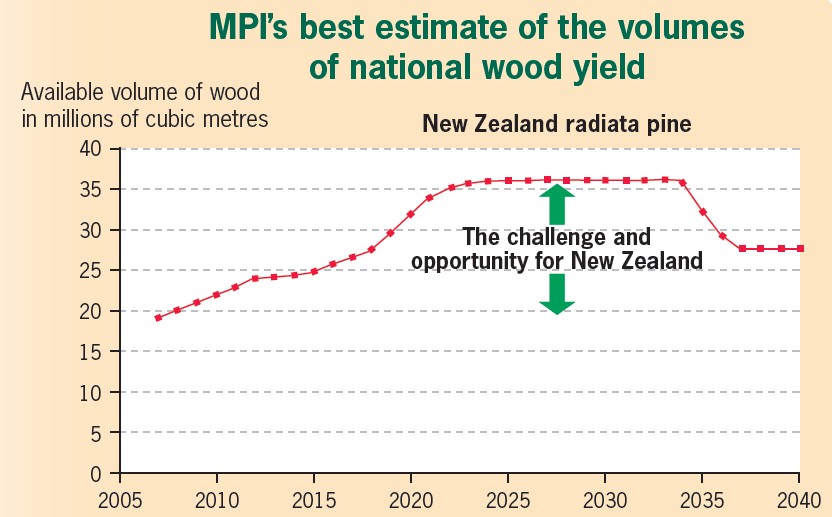

Let us assume that most radiata pine stands will be harvested when they are about 28 years old. From the mid-1990s boom in new planting, commonly called the wall of wood, the harvest is likely to be completely by 2036 as shown by MPI’s forecast on the graph below.

You might think the graph implies that New Zealand trees planted over the next few years will be maturing after the wall of wood has been harvested − when local sawmills will be short of logs and when good prices should be being offered to growers. However, this ignores the fact that the trees harvested between 2020 and 2036 will be replanted and we can expect a new wall of wood between 2048 and 2054. This is about the same time that any new planting carried out over the next decade will be maturing.

Such forecasts may be confounded by other factors. For example, over the next decade some forest owners may choose to convert their plantations to manuka, or back to pasture, instead of replanting. Another consideration is the fact that almost all of the 2020 to 2036 wood supply spike and its expected echo about 28 years later, comes from stands classed as ‘post 1989’ under the Emissions Trading Scheme. If the price of carbon sequestered by trees remains substantial, as seems probable, then many forest owners may well choose to delay harvesting their crops, which would flatten the spike we call the wall of wood.

Global supply sets prices

Undesirable boom and bust cycles are caused by regional asymmetries in forest area and age class distributions. The wall of wood we are just beginning to harvest is already increasing costs as a result of shortages of skilled labour and machinery, although later costs should drop when there is not enough wood to keep all the workers and their gear busy.

In addition, no matter how much local wood comes on stream over the short to medium term, if supply cannot be sustained there will be no increase in local wood processing, which means there will be no overall increase in domestic demand for wood. But that is mainly irrelevant to the price local millers will offer for logs. Log prices obtained by forest growers are ultimately set by the global supply and demand for wood. In the end, factors external to New Zealand, particularly the Asian supply and demand for logs, shipping costs, the dollar exchange rate play the major part in what a New Zealand miller will offer a forest owner for their logs.

Global demand

What will global demand be for wood in a world where population and wealth is increasing? The Food and Agriculture Organisation say that the global population, currently 7.5 billion, is expected to have increased to

10 billion by 2050. Assuming the average use of wood remains at about 0.6 cubic metres a person each year, and the yield from new plantations averages 500 cubic metres a hectare, then 1.5 billion cubic metres more wood will need to be produced each year. This means three million more hectares a year of radiata pine forest equivalent will need to be harvested annually. Compare this to 50,000 hectares a year, which is about the expected area New Zealand will be harvesting once the wall of wood, has passed through.

New Zealand will probably continue to supply what are considered to be the stable timber markets of Australia, Japan, Korea and the United States, but our major future log market is likely to be China and India. In a recent market report the ANZ bank said ‘While China has undertaken a lot of construction activity over the last 10 years, more is still required over coming decades…. and over the longer term, India offers good growth opportunities for New Zealand wood exporters.’

Global supply

Where will the increased global supply of wood come from? If three million more hectares are to be harvested annually, about the equivalent of 100 million hectares of New Zealand-type radiata pine forests will be needed globally. However, far more forest than that will be needed because more than 90 per cent of the current global wood supply is still coming from natural forests, most of which is not being managed sustainably, is being degraded or is being converted to different land uses.

Modelling world wood supply is complex, and getting accurate input data is even more difficult The FAO’s last relevant forecast was published in the year 2000, only looked ahead until 2010, and was of dubious reliability. However, given the pressure on land for increased agriculture, the increased demand to set aside natural forest for conservation, the high levels of capital needed to manage natural forests well or establish new forests, and the fact that it takes decades to get a return on investment in forestry, it seems likely that wood supply will be falling short of demand by the time the trees mature in any New Zealand forest planting in the next few years.

Future competition from substitutes

At least ten times as much energy is needed to produce substitutes for wood as is required to produce wood itself. Therefore, widespread substitution is not possible unless the world finds a cheap, large-scale, renewable, non-polluting new energy source. In addition, any increase in energy prices will result in large cost increases in making such substitutes.

Substitutes which have displaced wood in particular roles in construction are now being ousted by new forms of engineered wood. Conventional wood in the form of beams, posts, framing and joinery were substituted out of the building industry during the last century by steel, concrete, aluminium and plastics. Now wood is making a comeback via engineered wood products which are finding their way into all sorts of construction.

These include optimised engineered lumber, cross-laminated timber, glue-laminated timber, parallel-strand lumber, laminated-strand lumber, laminated-veneer lumber and wood I-joists. They all provide performance certainty in their inherent specifications

Wood is also becoming stronger. The GF Plus genetic improvement scheme for radiata pine allows tree buyers to grow trees with greater wood density than before.

The use of wood in buildings and other wooden products lock away embedded carbon for the lifetime of the structure. This has been discussed as part of the current Emissions Trading Scheme review, and it is likely that government will at least indirectly recognise it with financial incentives.

The effect of the Emissions Trading Scheme

A number of high-profile studies have demonstrated that the benefits of strong and early action on climate change outweigh the costs of not acting, and since the Paris climate change conference in late 2015, every country in the world except USA has agreed to act to reduce emissions. Moreover, it is unlikely that the USA will remain an exception for long.

The International Energy Agency says that the carbon price the developed world will eventually have to impose is US$190 a tonne, equivalent to around NZ$270 a tonne, if the Paris agreement on greenhouse gas emission reductions is to be achieved. Different countries have different emission profiles and different ways of modelling this price. However you look at it, a New Zealand Unit at price of $19.25 a tonne, the value in mid November 2017, is a bargain, and is likely to rise substantially, given the Adern-led government’s statement that it intends to take a lead role on ameliorating the effects of climate change. A sustainably managed radiata pine forest stores approximately 300 tonnes of carbon for each hectare. Carbon is therefore a strong potential forest revenue stream

Supporting reports

New Zealand’s Paris commitment is by 2030 to reduce nett emissions by 30 per cent below 2005 levels, which means that increasing abatement will be needed over coming years. In April 2017 Parliament debated a recent report snappily entitled Net Zero in New Zealand: Scenarios to achieve domestic emissions neutrality in the second half of the century. It was prepared by Vivid Economics and commissioned by Globe-NZ a cross party group of 35 MPs concerned about policy to ameliorate climate change. All the MPs in the house supported it, which bodes well for the possibility of future cross party agreement on the management of the ETS.

Vivid Economics have indicated that a New Zealand Unit price of at least $50 a tonne will be needed to meet the Paris target. This is a good deal less than the International Energy Agency’s recommended price, but at $50 a tonne, afforestation will be very profitable In addition, a March 2017 report by the OECD about the state of the New Zealand environment, and an October 2016 report by the Parliamentary Commissioner for the Environment, agree that New Zealand needs land use change involving the afforestation of about another million hectares of plantation forest.

All the mentioned contributors also note that, apart from carbon sequestration, forestry has many co-benefts that are not yet monetised. However, thanks to ecosystem research carried out by Scion, these benefits are being quantified financially Such co-benefts probably far exceed any commercial benefits that current forest investors are receiving.

Investment in afforestation

The following data comes from an ANZ March 2017 report on forest investment. It calculates returns for a range of these main variables for a pruned radiata pine forest, with a 28-year rotation, applying average prices from the past year.

The carbon prices are modelled at $18 a tonne, a bit less than the current price, and it is assumed 80 per cent of the carbon is released at harvest. The remaining 20 per cent is assumed to be ‘safe’, with the forest replanted for a second rotation. A discount rate of seven per cent has been applied, which is in line with the long-run cost of capital for the primary sector.

The results for good forests which are within 200 kilometres of a port or mill show an average pre-tax real rate of return, excluding carbon revenue, of 6.3 per cent, with a range of 4.4 to 7.9 per cent. If you include carbon revenue, the average pre-tax real rate of return rises to 9.9 per cent, with a range of 8.3 to 11.2 per cent.

The genetics of radiata pine are being enhanced all the time. For example, a GF 23 trees will produce a 27 per cent volume gain over unimproved stock at maturity. Planning and inventory is being upgraded by using remote sensing and drones. High technology harvesting machines, using robotics, are increasing productivity, and reducing the cost of extracting trees on steep slopes, as well as reducing hazards to workers. Such research and development will continue to improve the profitability of afforestation.

Hamish Levack is a member of the NZFFA Executive.

Farm Forestry New Zealand

Farm Forestry New Zealand